Our Stop the Family Farm Tax campaign to halt the unfair and destructive changes to Inheritance Tax announced in the Autumn Budget has delivered huge public and political support and is beginning to cut through with Labour MPs too.

But we know the Chancellor is determined not to move, so we must keep up the pressure.

1. Add your name to show your support

Our Stop the Family Farm Tax petition has been handed into No.10 Downing Street. But you can still join more than 270,000 people who have already added their names.

Don't forget to:

- Share on social once you've added your name using our hashtag #StopTheFamilyFarmTax

- Send to your family and friends and anyone who loves and enjoys our precious, rural areas.

2. Tell your story

Use our new email your MP tool to help MPs understand the consequences of the family farm tax for your family.

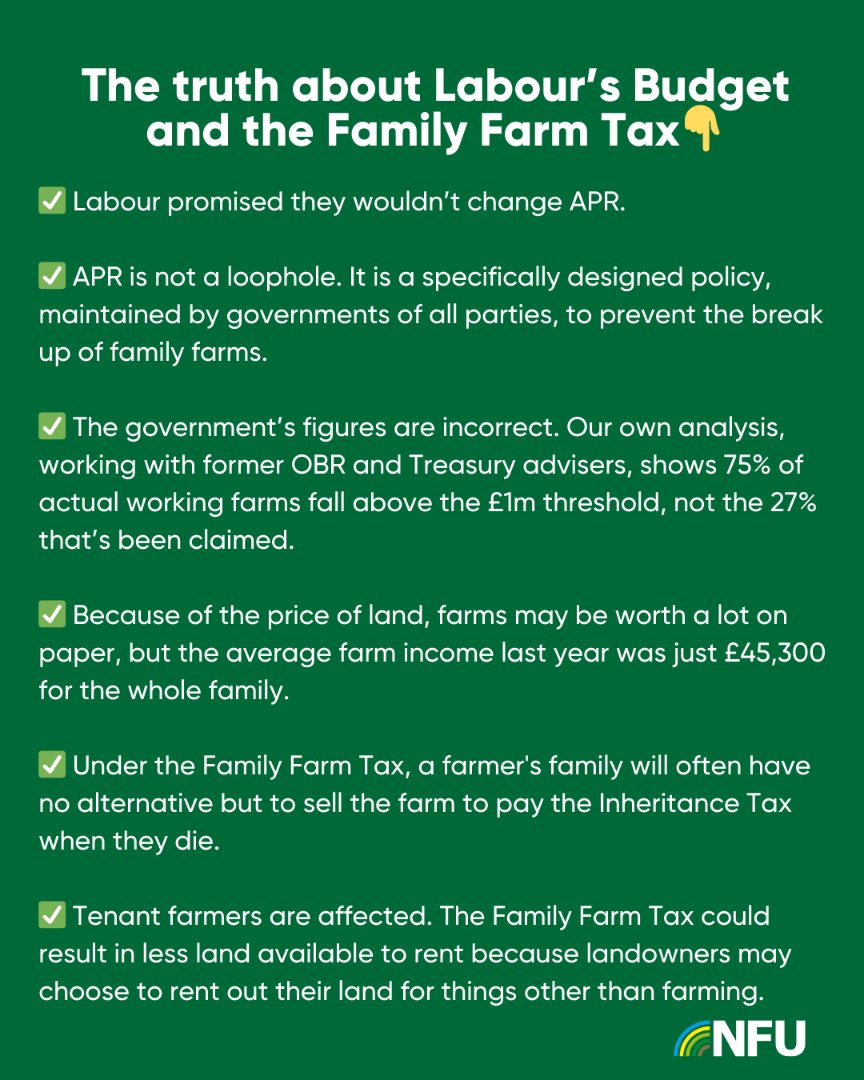

Read: How much could a family farm pay under the new IHT reforms? which provides a breakdown of what five, real family farms could pay under the proposed reforms to APR and BPR. You may find this information useful to help explain your individual situation.

Did you attend our mass lobby?

Use our online tool to follow up with your MP to keep the pressure up and remind them this issue is not going away.

3. Meet with your MP

MPs from all parties tell us they need examples. It's been brilliant to see case studies you've sent through so far and please keep them coming. But through the rest of December and early January we want members who can to meet their MPs together with their accountants and advisers. MPs will then see first-hand, in the data for individual farms, that the Treasury lines claiming few farms will be affected by the APR/BPR changes are wrong.

You can also share our impact analysis, produced in consultation with former Treasury and Office for Budget Responsibility economists, which shows the calculations in detail to prove why the Treasury is working off the wrong figures.

4. Display your banners

Thursday 19 December was pronounced a day of national solidarity for farming and saw the NFU, in collaboration with farming unions NFU Cymru, NFU Scotland and the Ulster Farmers’ Union display banners up and down the country.

Designed to be highly visible in key political constituencies, the aim is to focus public attention and build political pressure on the devastating impact these changes would have on farming families and rural communities.

NFU members and the public can now order campaign materials such as banners and car stickers through our online shop, due to be launched in the new year.

5. Share the message on social

Use the hashtag #StopTheFamilyFarmTax to help keep this issue in the public eye and don't forget to tag us:

- X (Twitter) – @NFUTweets

- Facebook – NFU – National Farmers’ Union

- Instagram – @NFULife

6. Allied businesses – sign our pledge

We know agriculture-related industries share our concerns about the government's family farm tax.

Add your name to ask the government to pause and consult and show them the strength of feeling and impact across the allied industries.

The government may hope that we will give up over time, but we know that we’re in this for the long haul.

If you’ve been able to tick every box that’s great news and thank you for helping us fight this awful family farm tax. But please do continue to keep an eye out for more ways to get involved in the campaign.